Effective Life Of Solar Panels Ato

I would like to depreciate this item but this asset is not listed on the ato depreciating items.

Effective life of solar panels ato. As such they are depreciable under the capital allowances provisions of the tax act. How the ato determines the effective lives of assets. The schedule of effective life determinations has been progressively updated since 1 january 2001. Completed effective life reviews.

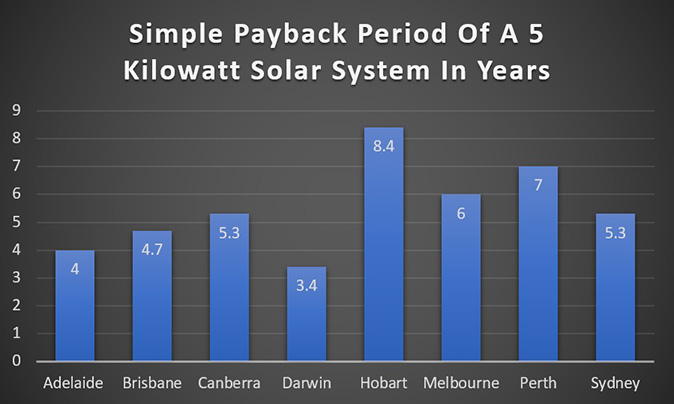

The ato determines effective lives through an effective life review process. The following is a list of effective life reviews that have been completed including the date of effect of the new effective lives. You may have to recalculate the effective life if you make an improvement to an asset that increases its cost by 10 or more in a year. In its latest determination the ato has ascribed 20 years as the effective life of solar panels and therefore they are depreciable over this time period.

I wonder if i can use the guarantee which is 5 years as useful life for calculating depreciation. Below are the ato effective lives for residential property as at the 1st of july 2017 from tr 2017 2. The effective life legsilation has been updated. Recalculating a depreciating asset s effective life.

For the most up to data effective lives go to the ato effective lives section under the depreciation schedules menu dropdown.